Spreads on bonds issued by Nvidia Corp. have widened this week while the rest of the so-called Magnificent Seven issuers have remained flat, signaling that bondholders are just as worried about the risk posed by Chinese AI startup DeepSeek as shareholders.

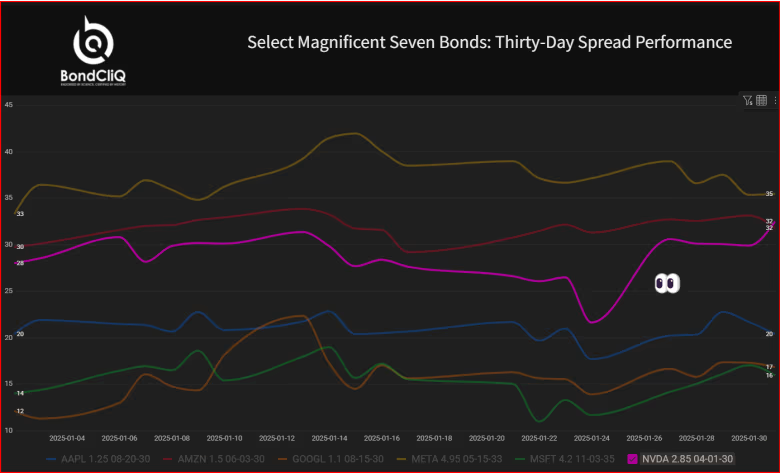

The following chart from data-solutions provider BondCliQ Inc. demonstrates the trend, with Nvidia’s 2.85% notes due April of 2030 about 10 basis points wider since news of the AI app got investors’ attention on Monday. The rest of the Magnificent Seven group’s spreads are flat or a few basis points tighter.

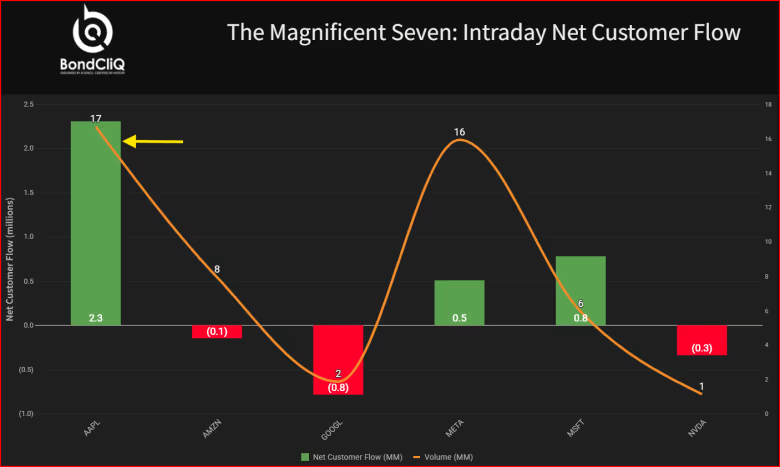

There was net selling of Nvidia’s bonds on Friday, but buyers were snapping up bonds issued by Apple Inc., which has the most outstanding debt of the group.

Nvidia’s stock, meanwhile, has fallen 12% on the week. That’s equal to $416.8 billion of lost market capitalization.